We’ve spoken a lot recently about digital marketing budget controls to prevent PPC overspending. Identified some of the ways in which agencies are attempting to keep an eye on budgets to prevent overages and the necessity of having a solution (any solution) in place as your client-base grows and the risk of overspend increases.

The focus, to date, has been monitoring ad spend by platform for each client. Setting up a monthly budget alongside each platform, each month, and tracking live actuals alongside actual spend to ensure you’re not spending too much. Is this enough to ensure you’re adequately protected from risk? No. Why? Two reasons: firstly, because a budget monitoring system is only as good as its alert mechanism, and secondly, the effort-to-risk ratio. Both of these issues can be grouped under a single challenge: it is hard to stay plugged into the prospect of risk all the time.

Budget Monitoring is Only as Good as its Alerts

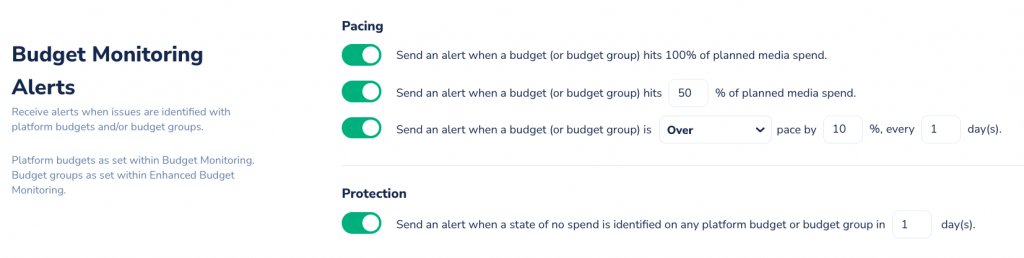

Let’s address the first point: your PPC budget monitoring system is only as good as its alert mechanism. Of course, just tracking budgets isn’t enough, nor frankly is an alert system that just tells you when you’ve gone over budget – it’s too late then. Monitoring needs to be partnered with intelligent alerts that identify the risk early in order to give you the opportunity to rectify the problem.

Build thresholds that align with the unique nuances of your client and your client’s campaign. Ensure that, yes, you are alerted should the budget go over – but also that you’re alerted if the budget looks like it might go over based on current trends.

Watch Budgets Across Clients At Scale

The second point concerns two things, the requirement (ergo risk) of being a good custodian and noise. The reality is (hopefully) that digital marketing overspend isn’t happening to you every single month. It may not happen for months at a time. As a result, it can be difficult to stay plugged into the systems that are there to monitor it. Alerts can help – but alerts can get lost among the noise of the day-to-day or where an alert profile has not been set up discerningly enough.

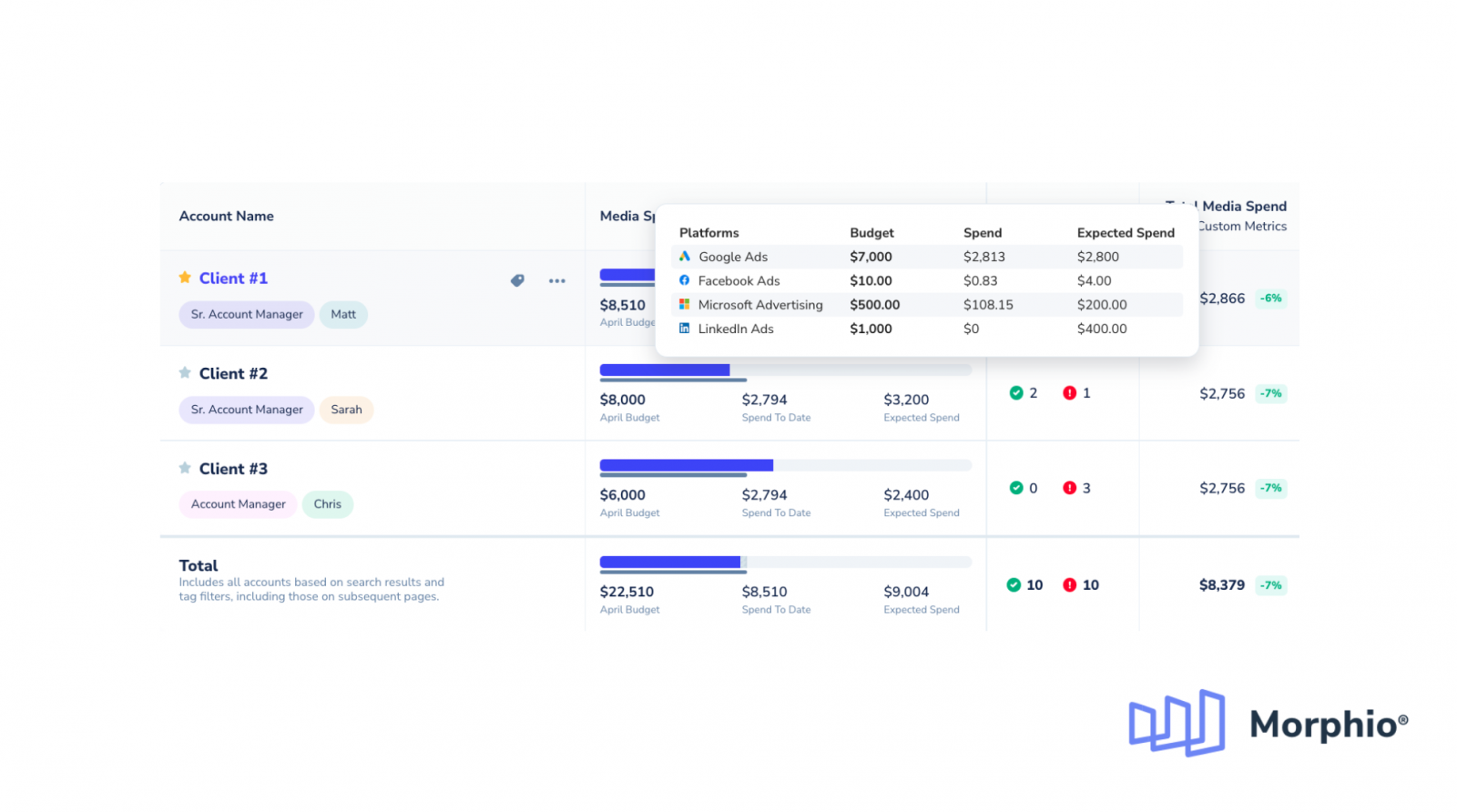

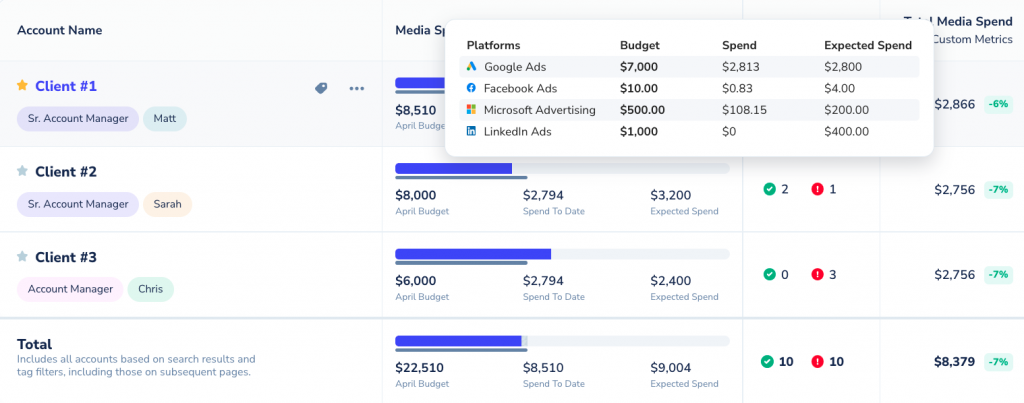

One way to counteract this is a system that allows you to see, at scale, agency-wide budgets. A system that doesn’t necessitate a client by client review of budgets, an easy way to see everything (including overspend) at once.

The key to managing risk in any situation is not complete until you’ve then also scrutinized the systems you use to manage that risk. Identify the issues within that system and find further solutions that help your humans. If your budget monitoring system can not only track budgets and report overages, but can also be intelligent in identifying overspend trends and making things as accessible as possible, then you’re in good standing. If not, well, maybe give Morphio a try.